Our Process

A strong planning process is the best way to create a strong, flexible financial plan.

A transparent, effective planning process is based on two key aspects of financial planning: protection and access to funds when needed. A plan must ensure liquidity, to allow its owner to access funds when needed. It must also take into account key stages of life. This can include preparing for events such as retirement, death, and in the event of disability and/ or critical illness.

With these goals in mind, the first step in building a comprehensive plan is to assess total financial planning needs. This involves a consideration of important milestones such as retirement, insurance, major purchases and educational costs, as well as ongoing financial management strategies. Once these factors are identified, the client is prepared to choose the products and services that best address his or her needs.

This goal-based financial planning approach is designed to help:

- Define customized short-and long-term goals that ensure only the right financial products and services are chosen

- Identify roadblocks or gaps that might impact the financial planning strategy

- Continually monitor the plan to ensure it meets changing needs and circumstances

We follow a client-focused process to pursue specific milestones on your road to financial freedom.

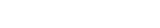

Our team does this by following a six-step process.

Step 1: Identifying your needs and objectives

As a community focused financial service provider, every individual matters. That's why it's vital for us to build a lasting, personal relationship with you, which will ultimately enable us to anticipate your needs and plan for the future.

Step 2: Gathering information

Depending on the services you require, this step might entail gathering information about your assets and liabilities, understanding your risk profile and get a better picture of your future goals. We usually complete this step of the process by asking our clients to complete a confidential personal profile that helps us gain a deeper understanding of your current financial situation and goals.

Step 3: Analyzing and evaluating your information

After gathering your information, we do an in-depth analysis to determine where you are at in your financial picture, and what you will require to achieve your financial goals.

Step 4: Developing your plan

Once we have completed our analysis, we draw up an individualized plan to help you work toward your goals. Part of this process is to meet up with you and presenting this plan to you, which provides you with an opportunity to raise any concerns and revise our recommendations as appropriate. We also agree on how your plan will be carried out.

Step 5: Implementing your plan

Putting a financial plan into action is often easier said than done. It takes a lot of discipline and guidance to maintain a sustainable savings or investment plan, but that’s where our promise to you can make all the difference. By being there for our clients and being there with them every step of the way, we ensure that their financial plans are successfully implemented.

Step 6: Reviewing your progress

As part of our responsibility to provide you with peace of mind, we regularly monitor the progress of your financial plan and provide you with timely feedback. We also use our interaction with you as an opportunity to find out if there have been any changes in your life that might affect your financial plan – for example getting married, the birth of a child or changing jobs.